SHORT EXPLANATORY NOTE

on Publication of Shadow Auctions ATC in the parallel run framework:

CWE partners are now starting the daily publication (with a retroactive effect as of February 25th) of the shadow auctions ATCs which will be calculated and used for eventual shadow auctions after the go-live of the CWE FB market coupling.

The object of this note is to clarify the methodology supporting the computation of these ATC for SA.

1.1. ATC for Shadow Auctions: extract from the approval package

Introduction: In case of a decoupling in CWE, the philosophy remains the same as in ATC Market Coupling, explicit shadow auctions (SA) will be organized.

With the TSO CS up and running, one Flow Based domain per hour of the business day is determined as an input for the FB MC algorithm. In case the latter system fails, the Flow Based domains will serve as the basis for the determination of the SA ATCs that are input to the Shadow Auctions. In other words: there will not be any additional and independent stage of ATC capacity calculation.

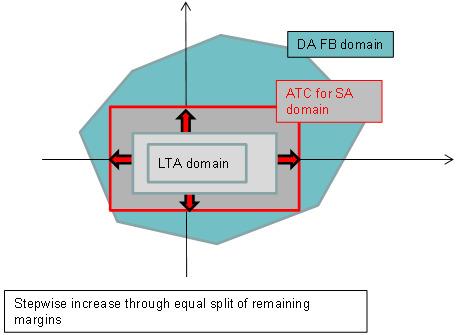

As the selection of a set of ATCs from the Flow Based domain leads to an infinite set of choices, an algorithm has been designed that determines the ATC values in a systematic way. The algorithm applied for the determination of the SA ATCs is the same as the algorithm applied to compute the ID ATCs after the FB MC, though the starting point of the computation is a different one. Indeed, the iterative procedure to determine the SA ATC starts from the LTA domain1 as shown in the graph below.

Input data:

Except for the two days per year with a long-clock change, there are 24 timestamps per day.

The following input data is required for each timestamp:

• LTA

• presolved Flow Based parameters that were intended to be sent to the PXs

Output data:

The calculation leads to the following outputs for each timestamp:

• SA ATC

Algorithm:

The SA ATC calculation is an iterative procedure.

Starting point: First, the remaining available margins (RAM) of the presolved CBs have to be adjusted to take into account the starting point of the iteration.

From the presolved zone-to-hub PTDFs (PTDFz2h), one computes zone-to-zone PTDFs, where only the positive numbers are stored (pPTDFz2z)2:

pPTDFz2z(A > B) = max(0,PTDFz2h(A) - PTDFz2h(B))

with A,B = DE,FR,NL,BE at the moment. Only zone-to-zone PTDFs of neighboring market area pairs are needed (e.g. pPTDFz2z(DE > BE) will not be used).

The iterative procedure to determine the SA ATC starts from the LTA domain. As such, with the impact of the LTN already reflected in the RAMs, the RAMs need to be adjusted in the following way:

RAM = RAM - pPTDFz2z*(LTA - LTN)

Iteration: The iterative method applied to compute the SA ATCs in short comes down to the following actions for each iteration step i:

1. For each CB, share the remaining margin between the CWE internal borders that are positively influenced with equal shares.

2. From those shares of margin, maximum bilateral exchanges are computed by dividing each share by the positive zone-to-zone PTDF.

3. The bilateral exchanges are updated by adding the minimum values obtained over all CBs.

4. Update the margins on the CBs using new bilateral exchanges from step 3 and go back to step 1.

This iteration continues until the maximum value over all critical branches of the absolute difference between the margin of computational step i+1 and step i is smaller than a stop criterion.

The resulting SA ATCs get the values that have been determined for the maximum CWE internal bilateral exchanges obtained during the iteration and after rounding down to integer values.

After algorithm execution, there are some critical branches with no remaining available margin left. These are the limiting elements of the SA ATC computation.

The computation of the SA ATC domain can be precisely described with the following pseudo-code:

While max(abs(margin(i+1) - margin(i))) > StopCriterionSAATC

For each CB

For each non-zero entry in pPTDFz2z Matrix

IncrMaxBilExchange = margin(i)/NbShares/pPTDFz2z

MaxBilExchange = MaxBilExchange + IncrMaxBilExchange

End for

End for

For each ContractPath

MaxBilExchange = min(MaxBilExchanges)

End for

For each CB

margin(i+1) = margin(i) – pPTDFz2z * MaxBilExchange

End for

End While

SA_ATCs = Integer(MaxBilExchanges)

Parameters:

StopCriterionSAATC (stop criterion); set at a 1.e-3 value.

NbShares (number of CWE internal commercial borders); current value is 4.

1.2. Usage / interpretations of these values

The publication of the SA ATC is part of the general transparency framework that CWE partners have developed, in close communication with market participants, in order to facilitate market transition from ATC to Flow Based.

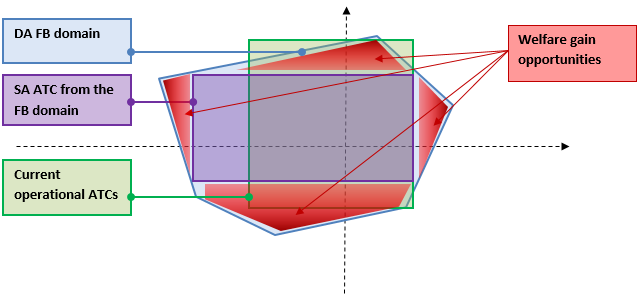

In this respect, shadow ATC can indeed be seen as a kind of “simplified (and reduced) FB domain”, which may facilitate analyses on the long run. However, one should keep in mind that SA ATC remain the product of a somehow arbitrary decomposition of the FB domain, therefore these ATC eventually reflect not only the FB parameters but also the effect of the splitting rule itself. In other words, a different rule could result in very different SA ATCs, even if applied to the same FB domain.

In addition, the splitting rule will mechanically result in a capacity domain potentially discarding the FB market coupling clearing point and the areas where the most welfare could be realized.

For these reasons, project partners would recommend market parties to be extremely cautious when analyzing the published SA ATCs. The real, full capacities remain the FB domain, while SA ATC can only be seen as an arbitrary reduction of it. Relying too much on SA ATCs could therefore result in losses of market opportunities.

Finally, CWE partners would like to remind that while SA ATCs are “arbitrarily” derived from the FB domain, currently used ATCs are computed in an independent way. SA ATCs may therefore differ significantly from the current ATCs in some occasions. For these reasons, market parties are invited to be extremely cautious if tempted to compare operational ATCs and SA ATCs from the parallel run.

The main “features” of SA ATC are illustrated on the sketch below:

- Derived from the FB domain (included inside), and therefore limiting the areas of the security domain providing the most welfare gain expectancy. Indeed, the fact that ATCs are simultaneously feasible prevents access to the extreme parts of the capacity domain.

- As an outcome of an operational process independent from the current ATC market coupling one, the values can significantly differ (below the green and violet areas).

1: Keep in mind that that the LTA domain will systematically be included in the FB one.

2: Negative PTDFs would relieve CBs, which cannot be anticipated for in the SA capacity calculation.